sales tax on clothing in buffalo ny

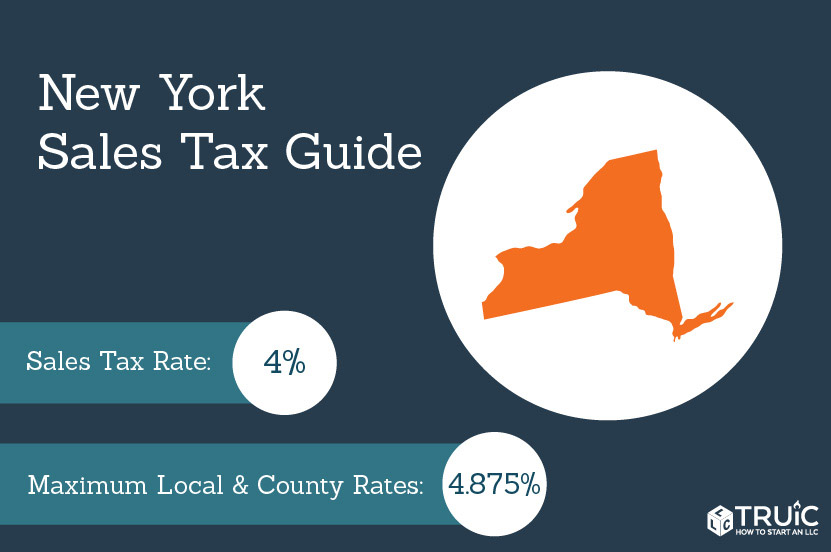

You can print a 875 sales tax. If youre clothing total is under 110 I believe the 4 NYS tax is waived.

Clothing Sales Tax Exemption Saving Families Money Ny State Senate

Download all New York sales tax rates by zip code.

. Buffalo is located within Erie County New York. Beginning Sunday clothing and footwear priced under 110 will be exempt from Sales tax break on clothing expanding. The current total local sales tax rate in Buffalo NY is 8750.

Anything above this amount is considered a luxury item. This includes the rates on the state county city and special levels. Cheektowaga NY Sales Tax Rate.

The Erie County New York sales tax is 875 consisting of 400 New York state sales tax and 475 Erie County local sales taxesThe local. In the state of New York the clothing exemption is limited specifically to footwear and clothing which costs no more than 110 dollars for each item or pair. Buffalo NY Sales Tax Rate.

Buffalo NY Sales Tax Rate. Like Massachusetts New York and New York City offer exemptions for most clothing items up to 110. Burlingham NY Sales Tax Rate.

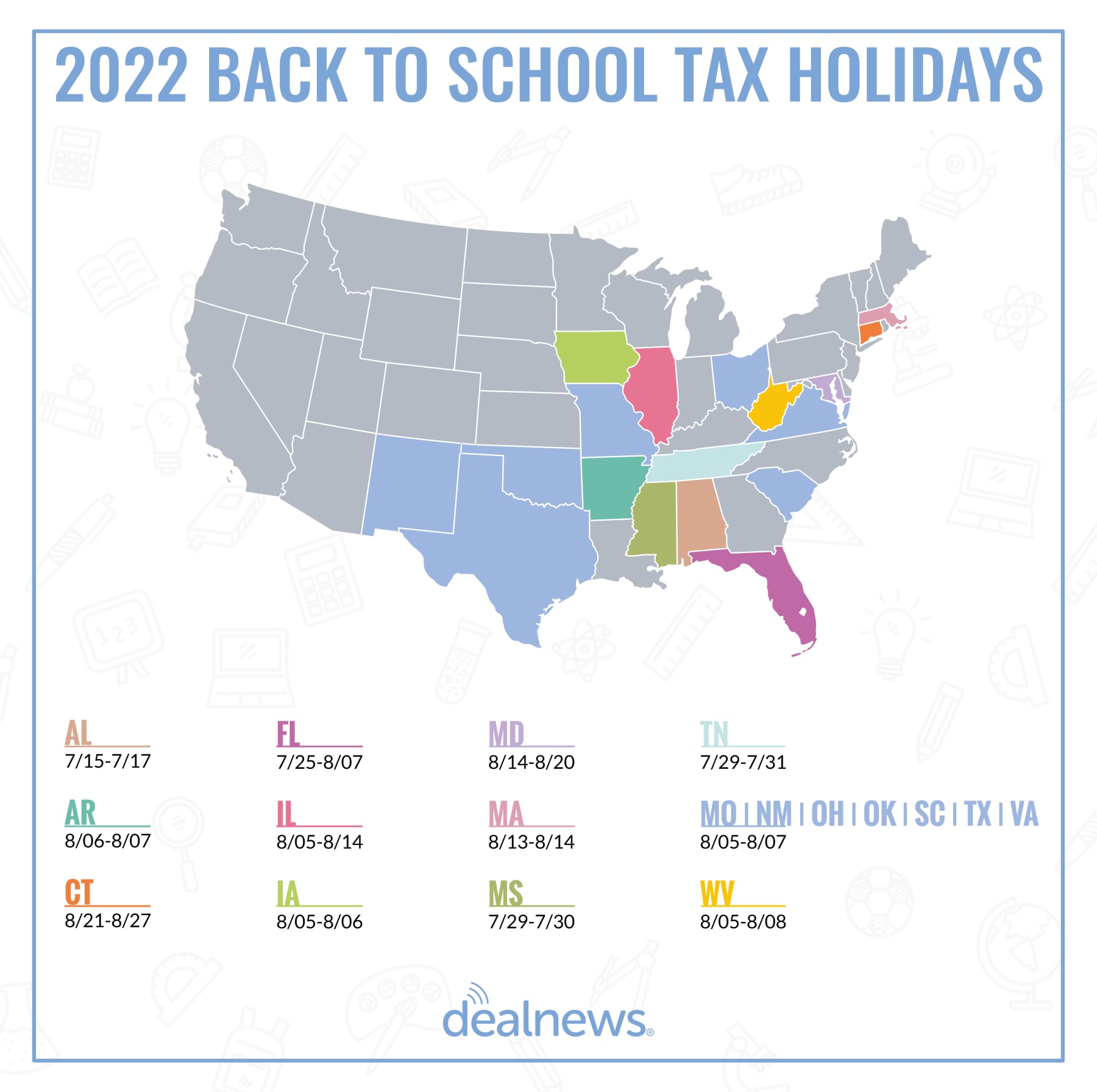

Sales and Use Tax Rates on Clothing and Footwear Effective March 1 2022 Clothing footwear and items used to make or repair exempt clothing sold for less than 110 per item or pair are. Now through Sunday the state is lifting its. There is no applicable city tax or special tax.

East New York NY Sales Tax Rate. No state levy on item costing less than 110 Latest. The average cumulative sales tax rate in Buffalo New York is 875.

The December 2020 total local sales tax rate was also 8750. The New York state sales tax rate is 4 New York Sellers permit. Any clothing items or pairs of.

Buffalo NY Sales Tax Rate Buffalo NY Sales Tax Rate The current total local. There is no applicable city tax or special tax. Clothing footwear and items.

Buffalo NY Sales Tax Rate Buffalo NY Sales Tax Rate The current total local sales tax rate in Buffalo NY is 8750. The New York sales tax rate is currently. The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax.

Coney Island NY Sales Tax Rate. The 875 sales tax rate in Buffalo consists of 4 New York state sales tax and 475 Erie County sales tax. Products services and transactions subject to Sales Tax get Sellers Permit in the State of New York.

Sales Tax 5 years ago Save 875 If youre clothing total is under 110 I believe the 4 NYS tax is waived. The minimum combined 2022 sales tax rate for Buffalo New York is. This is the total of state county and city sales tax rates.

So you would end up with just the 475 county tax. By Mark Scott Buffalo NY A sales tax-free week on clothing purchases in New York began Monday.

Certificate Of Authority New York Sales Tax Truic

Cities With Highest Sales Tax Sales Tax Rates By City Tax Foundation

Barclay Wants Sales Tax Limits To Ease Sting Of Inflation

The New York Clothing Sales Tax Exemption Demystified Taxjar

Tax Free Which State Will Suspend Sales Taxes This Week Marca

Legislation On The Table To Increase Ny Sales Tax Exemption

Cities With Highest Sales Tax Sales Tax Rates By City Tax Foundation

Taxes Visit The Usa L Official Usa Travel Guide To American Holidays

Retail Sales Tax Exemption A Guide For Retailers And Buyers

Cross Border Shopping In Buffalo Ny From Toronto Best Tips

How To Avoid New York Sales Taxes At The Mall Newyorkupstate Com

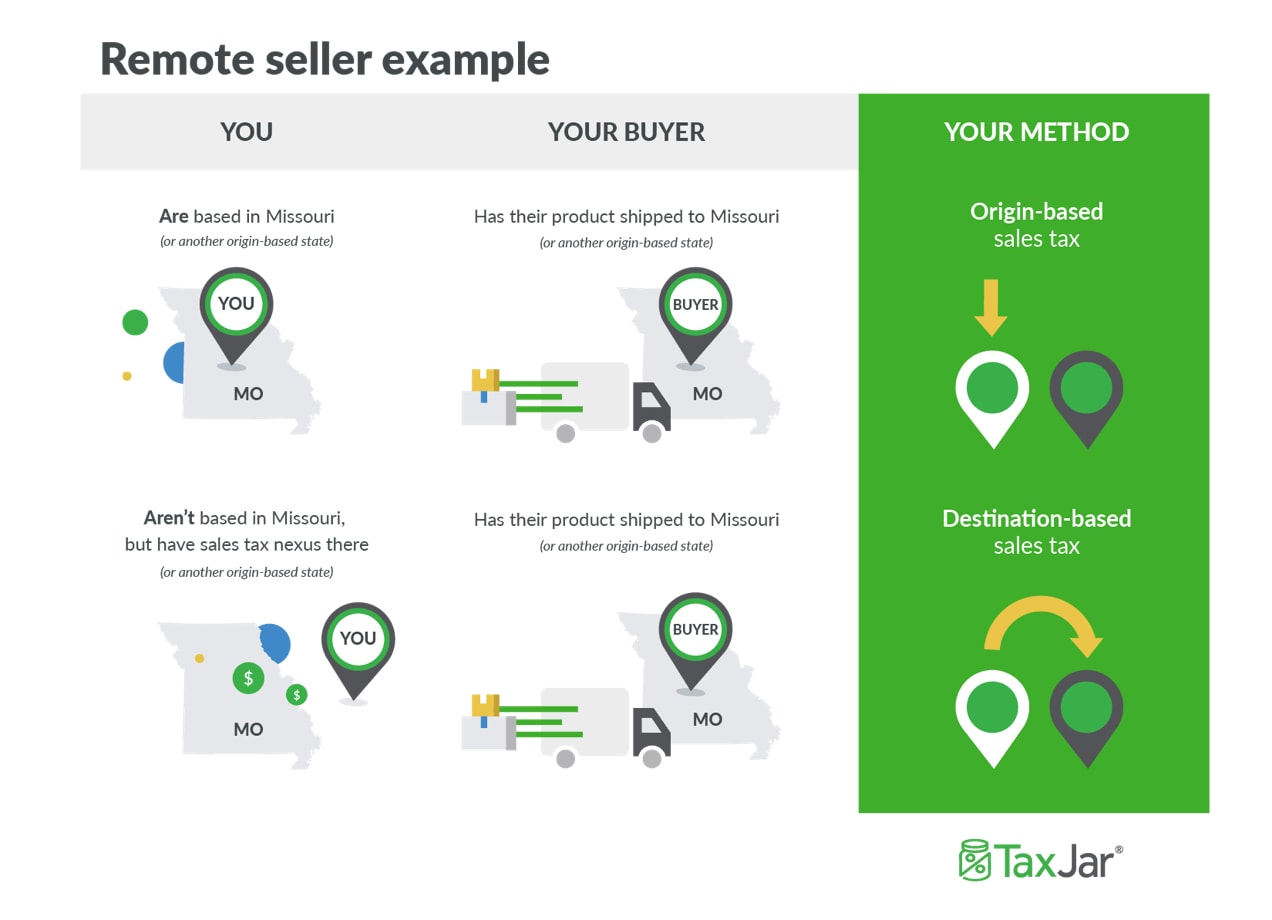

Should I Charge Sales Tax In My Online Boutique Start Your Boutique

What Ecommerce Startups Need To Know About Online Sales Tax Bplans

Legislation On The Table To Increase Ny Sales Tax Exemption

Which States Require Sales Tax On Clothing Taxjar

When Is Your State S Tax Free Weekend In 2022

Buffalo Ny 1910 Postcard Main Street Downtown Looking North New York Ebay